It looks like another Government shut down was averted, quite literally in the 11th hour Friday night. An agreement was reached to fund government operations through the end of September. Only $38.5 billion dollars was cut from the budget, which is a trivial amount compared to the extremely large budget deficit of $1.6 trillion dollars. With the new war in Libya adding costs not calculated in (ranging from $600 million to $1 billion), our annual spending deficit continues to rise.

This blog attempts to educate people about how our economy works and to provide updates on what is going on in the economy that may affect them (See personal story at the bottom of the page). Neither this blog nor I are investment advisors, any opinions posted on this site are my own. Please seek a professional investment advisor to fit your personal investment goals.

Economic Charts

All economic charts are at the bottom of the page.

Saturday, April 9, 2011

Thursday, April 7, 2011

Initial Unemployment Claims

The Initial Unemployment Claims were released today showing initial claims somewhat moving sideways over the past few weeks. Initial Unemployment Claims measures the number of persons whom filed for unemployment benefits for the first time in the prior week. The forecasted number called for 385k, but the actual headline number came in at 382k. This may appear to be a small glimmer of good news, but we need to see what the revision will be. The revision of the headline number is what we need to keep our eye on as last weeks number of 388k was revised up to 392k. As we saw in the prior announcement the delta in revisions can be quite significant. The 4 week moving average is at 384k relatively moving sideways.

Wednesday, April 6, 2011

Weekly Money Flows

This week money flowed into domestic stocks instead of piling out. I have changed the charts a little bit to more of a line graph so you can get a better view of in/out flows. For the week of 3/30/2011 Domestic stocks had $345 million of in-flows and foreign stocks had $903 million in in-flows. For Bonds, Taxable bonds had in-flows of $3.552 billion dollars and Municipal bonds saw out-flows of -$465 million.

Debt Binge is Going to Hit a Wall

More and more talk of Government spending coming to an end, but very little action in doing so. At some point as the budget continues to grow with revenues not growing, our need to borrow has done nothing but go up. So what happens when nobody will lend us money (hitting the proverbial wall), except for the FED, whom will buy up our debt. The only problem with the FED purchasing all of our debt (QE) is that other countries faith in our dollar will continue to dwindle if not dwindle at an accelerated rate.

In the Rachel Maddow show, Paul Ryan discusses privatizing medicare and have retirees go out on the open market to get insurance (which is in bad need of reform). U.S. Citizens are not going to want to privatize Medicare as it leaves them very uncertain on their healthcare. So, this leaves as at a crossroads, how do you cut debt on overspending and not make a group of us or all of us out to dry. This will be an issue that will be tackled long term and I just cannot see this getting solved any time soon. A good answer would be to bring back jobs to the U.S. and raise revenues, while reducing deficits where possible (no easy answer).

The Unemployment Situation

I regretfully have been too busy to get data in on time these days (due to very little time), but I wanted to at least review the past month unemployment data from a higher level view. The reported U3 (measures only the number of officially unemployed) the rate moved down from 8.9% to 8.8%. What does this mean? Well as this does not take the number that has fallen out of those eligible for unemployment and they are not counted. U3 also does not take into consideration many other factors that U6 does. U6 (measures officially unemployed, Marginally attached workers, Discouraged and Part time for economic reasons) was down from 16.8% to 16.5%. But U6 still does not take into account those that are not counted, for a more accurate number we take U6 plus the number that are unemployed, but not counted, that want a job now and get a rate of 20.6% down from 21.0%. Still there are those that are not counted and have totally given up, which none of these numbers represent, but we will go through more. On the surface the unemployment rate does look better than it did (so this was an improvement), but with some caveats.

Figure 1. Unemployment Rate

Figure 2. Other factors

Notice in figure 3 the labor force participation since 2007 has been doing nothing but going down, and has somewhat evened out of late. The general trend though is is down though and will have to continue to be monitored as the unemployment rate is released month by month. If the unemployment rate goes down (good sign), but the labor participation rate continues to plummet then things are not improving.

Figure 3. Labor Participation rate since 2007

Figures 4 and 5 have a very telling story to understand. Figure 4 shows the civilian labor force that has been on the rise from 2001 to its height in 2008. Now it is moving sideways to down since 2008, but notice figure 5 shows those not in the labor force still rising sharply. So, while prior to 2008 we have been expanding the labor force, so seeing those not in the labor force rising is understandable as the job market has become tighter (more people). But now that employment has slowed down considerably, those not participating in the labor rate (not counted in the unemployment numbers btw) it is still rising sharply. We need to keep an eye for some reversals in trend here to truly embrace a recovery in jobs. Now I am all about supportive correlations and as we saw in the food-stamp assistance numbers they increased again in the month of March supporting the fact that more are not able to make ends meet with part time jobs or unemployed and not counted. Now Food-stamps did slow down in the month of March in terms of growth compared to February, but the number continues to grow and we need to see those numbers reverse.

Figure 4. Civilian Labor Force

Figure 5. Not in Labor Force

Tuesday, April 5, 2011

Gold and Silver Spikes on Weak ISM NMI

March's ISM Non-Manufacturing Index came in weaker than expected. The ISM (Institute for Supply Management) NMI (Non-Manufacturing Index) measures the level of a diffusion index based on surveyed purchasing managers, excluding the manufacturing industry. This is a survey of about 400 purchasing managers which asks respondents to rate the relative level of business conditions including employment, production, new orders, prices, supplier deliveries, and inventories. It is considered to be a leading indicator of economic health for multiple reasons; if prices are seen rising then sooner or later that will be passed on to the consumer reducing available dollars, it is also a snapshot of employment, indicator or new orders in the pipeline and etc. The forecast called for an index of 59.8, but the actual headline number came in at 57.3 leading some to believe that the likelihood of QE3 is more assured. You can see by the chart below gold (and silver) shot up at starting at 10am (same time the ISM NMI was released). Ref article from Business Insider here.

Courtesy of Kitco.com

ISM NMI part 1 shows indicators that should be rising. Businesses are very concerned about rising fuel costs and rising commodities. Business activity, exports and employment were down in the index for the month of March.

U.S. Fails Fiscal Fitness Test

Big money is getting out of Treasury's for a reason. Speculation says it is due to possible default by the U.S. Others say it is just a prudent move and things they do as portfolio managers. I find it interesting that it really hadn't made the press in the past if they had dumped them on a large scale before. Actually in summer of 2009, they actually recommended getting out of corporate bonds and in to U.S. Government securities. David Walkers (Fmr. U.S. Comptroller General) says the U.S. has failed his Fiscal fitness test and is heading for trouble.

Double Dip in Housing Coming?

More and more people are finally coming to the conclusion that housing is heading for a double-dip. If the existing/new/pending home sales numbers and the backlog of houses still on the market to sell didn't spell it out for you, well then here is some additional information by 60 minutes. HAMP (Home Affordable Mortgage Program) has been a miserable failure, with a high percentage those in the program being dropped from the program for default or other issues. The Mortgage mess (banks not having the proper paperwork) has only aided in kicking the can down the road a bit.

Sunday, April 3, 2011

Weekly Fund Flows

For the week of 3/23/2011 we saw more/increased selling in the domestic stock market. The Domestic market saw out-flows of -$2.508 billion and in-flows of $1.093 to foreign stocks. The Taxable bonds saw in-flows of $2.922 billion dollars and out-flows of -$569 million in Municipal bonds.

Weekly KWN Interviews

This week King World News interviews Robin Griffiths, Rob Arnott, Ben Davies and James Turk. Interesting interviews covering the Japanese economy, Gold/Silver, QE3 and other economic events that you need to keep up with.

Robin Griffiths - Discusses how the Japanese disaster and its effects on the Japanese economy. Robin believes that the disaster has made the Japanese economy cheap and buying opportunities may be available in 8 to 9 months. Robin says the inflation adjusted price in Gold is now at $3k per ounce and with the FED constantly printing, it should cause Gold to go towards $8k an ounce. Robin believes that Silver will accelerate faster than Gold will in the coming years. Robin believes that the dollars reign as reserve currency will diminish over the next few years due to its diminishing value. Robin says markets will be strong through May and June, but will see a replacement sometime after that.

Rob Arnott - Discusses Inflation and how the focus on core inflation excludes (food and energy) what the middle class depends on to survive. Rob talks about how we've ignored the proper measurements over the past 13 years which has cost us in GDP. Rob points out that Food and energy has gone up 5-10% (Tim: really higher depending on what your looking at). Rob says their are multiple camps in QE, but most of the votes are in the QE3 camp right now, but being quiet about it. Bernanke has pointed out that stocks have gone up since the starting of QE2, but that has not made the economy more healthy (so stopping QE would cause the markets to go down). Rob thinks that we have a possibility of a Greek style economic crash if we don't get things under control. Rob continues with more economic conversation which is well worth listening to.

Ben Davies - Discusses price controls which are used to fixed prices of commodities and services at a different level than the free market (preventing prices from rising). Ben says that usually this doesn't last very long and prices get out of hand faster than you'd expect. Ben points out that suppressing prices ultimately cause shortages in supply (and the supply/demand ratio is distorted). Ben comes up with a few examples of price controls that help illustrate this point very well. Ben points out that the Gold market is a clear example of price controls creating shortages in the market. Ben currently is more focused on the upside of Gold and sees Silver coming in for a short period of time. Ben is in the QE3 events due to the recent event in the world (being a very large event) causing gold to go higher. Be continues to discuss geopolitical issues and oil, which is valuable information.

James Turk - Discusses backwardation in silver and how we've gone from $27 to over $37 and it is still in backwardation. James says if Gold goes into backwardation then it is over for the dollar. James highlights that it is staggering that we are still in backwardation on Silver at these prices. James thinks there could be a break out in the Euro above 1.42. James believes we will break through 1440 in Gold pretty soon and then it should go much higher, it cannot be suppressed forever.

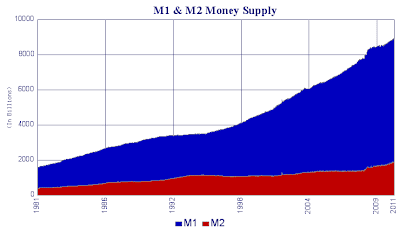

Weekly M1 and M2 Money Supply

This past week M1 and M2 saw increases. M1 money supply (which includes Currency, Travelers Checks, Demand Deposits, and other checkable deposits) increase by 1.3%. M2 money supply (which includes M1 plus, retail Money Market Mutual Funds, savings and small time deposits) rose 0.02%. M1 is 8.96% higher than it was 1 year ago and M2 is 4.35% higher than the year earlier.

March Food Stamp Numbers

The number of persons on food stamps increased in March to 44,187,831 from the prior months 44,082,324 an increase of 105,507 persons for the month. The following states had the additions above 10k:

| State | Change |

|---|---|

| OH | 10283 |

| MN | 11177 |

| UT | 12189 |

| PA | 12773 |

| MI | 19446 |

| CA | 32104 |

The following states had decreases greater than 10k:

| State | Change |

|---|---|

| TX | -27263 |

| LA | -11812 |

| AZ | -11360 |

FED POMO Purchases this Week

The FED performed 4 POMO (Permanent Open Market Operations) purchases this week totaling $17.409 billion dollars. This brings the total since November 3rd 2010 (when the FED announced $600 billion by June 2011) to $496.251 billion and $560.711 since August 17th 2010. With approx 3 months left the FED should exceed his target of $600 billion.

Subscribe to:

Comments (Atom)