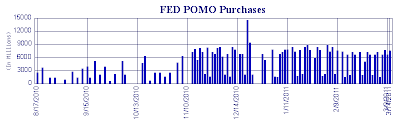

The FED performed another POMO (Permanent Open Market Operation) purchase today in the amount of $7.560 billion dollars. This brings the total since November 3rd 2010 (when the FED announced the printing of $600/900 billion dollars by June 2011) to $434.293 billion and $498.753 billion since August 2010.

This blog attempts to educate people about how our economy works and to provide updates on what is going on in the economy that may affect them (See personal story at the bottom of the page). Neither this blog nor I are investment advisors, any opinions posted on this site are my own. Please seek a professional investment advisor to fit your personal investment goals.

Economic Charts

All economic charts are at the bottom of the page.

Monday, March 14, 2011

Sunday, March 13, 2011

Consumer Credit for February 2011

I was listening to Karl Denninger (Market Ticker) this week and he broke down the Consumer Credit report and pointed out something very interesting, but before we get to that, lets talk about Consumer Credit. Consumer credit measures the change in the total value of outstanding consumer credit that requires installment payments. It's correlated with consumer spending and confidence - rising debt levels are a sign that lenders feel comfortable issuing loans, and that consumers are confident in their financial position and eager to spend money. This weeks consumer confidence number was forecast for 3.7B, but came in at 5.0B. On the surface and in the main media they saw this as a win, as if consumers are expanding credit then they are spending in the economy.

The problem that Karl points out and that I broke down in the report was that the major activity that caused the number to increase was Federal Government 5 loans. The number five correlated to Government Student Loans and the other commercial lending facilities (like commercial banks, credit unions, finance companies and others) actually reduced the amount of lending from the prior month. This shows that if you take Government Student Loans out of the picture, consumer credit actually contracted month over month.

The problem that Karl points out and that I broke down in the report was that the major activity that caused the number to increase was Federal Government 5 loans. The number five correlated to Government Student Loans and the other commercial lending facilities (like commercial banks, credit unions, finance companies and others) actually reduced the amount of lending from the prior month. This shows that if you take Government Student Loans out of the picture, consumer credit actually contracted month over month.

Weekly Unofficial Problem Bank List Update

Calculated Risk updated their "Unofficial Problem Bank List" this week with 964 institutions, with assets of $420.7 billion, now on the list. There were 2 removals and 4 additions this week. One removal came from the FDIC failed bank list where in Wisconsin Legacy Bank Failed, the other removal was due to an action termination on Northeastern Federal Bank in Connecticut (see more at CalculatedRisk.blogspot.com).

| State | Change |

|---|---|

| California | +1 |

| Connecticut | -1 |

| Florida | +1 |

| Iowa | +1 |

| South Carolina | +1 |

| Wisconsin | -1 |

Weekly M1 and M2

Money supply in M1 and M2 has been expanding in the past few weeks and certainly in respect to last year. M1 money supply, which is defined as Currency, Traveler's checks, demand deposits and other checkable deposits, rose 1.11% from the prior week and 10.09% from the year prior. M2 money supply, which is defined as M1 plus; Retail Money Market Mutual Funds, Savings and Small Time Deposits, rose 0.18% from the prior week and 3.97% from the prior year.

Weekly FDIC Failed Bank List

This week we had 2 banks failures, which brings the total for 2011 to 25 institutions. This past week we lost Legacy Bank in Milwaukee Wisconsin and First National Bank of Davis in Davis Oklahoma. We are slowing down on failures with respect to 2010 where we lost 30 banks by now. Hopefully this is a good sign for the Economy, but with more troubles for the U.S. coming I think this is more of a rest due to foreclosure freezes.

Weekly King World News Interviews

This week King World News interviews John Embry, Jim Sinclair, Rob McEwen & Jim Rickards. Great conversations on Gold/Silver, Bonds, QEIII, Economic fundamentals and the Dollar. QE continuance is a major factor of unrest in the currencies, getting these experts thesis as to why QE will continue is invaluable information. Jim Rickards gives a "Must Listen" interview about QE and how it can actually sustain itself now without requiring more QE beyond June (thus creating stealth QE).

John Embry - Discusses how the paper market for Gold has always dominated the physical buying, but now he sees the opposite happening. John says the dollar will fall pretty far against real assets, but not sure how much vs the other currencies, mainly as the other countries will sell their currency to match the dollar as much as possible. John believes that silver and gold are being sourced out of the ETF's when it gets in a pinch on supply. John points out that central bankers are clearly buyers of gold and silver as well as China as importation into China of gold and silver has risen. Great information from John on Gold/Silver and the dollar.

Jim Sinclair - Says gold will trade at 1500/1650 and the violence in gold and silver will continue if not rise. Jim believes that the underlying fundamentals in Gold has never been stronger as market fundamentals are extremely weak. He believes QEIII, QEIV and so on will happen because we don't have much choice. Jim believes that the dollar and long bond market are tied together, nobody wants to buy our bonds and the dollar is going to be wild but mostly to the downside. Jim says QEIII will happen because the recovery is too weak and the termination of QE would cause the equity markets to take a dive and that our future is to become a banana republic. Jim comments on Bill Gross' comments on bonds and says the only buyer of U.S. Bonds will be the FED through QE. Jim says that derivatives will eventually destroy our economy as it has done so much damage to date. Great information from Jim on the economy, metals, unrest and equities.

Rob McEwen - Discusses the cavalier attitude about risk in their wealth/investments, as there seems to be a belief that the Government will make it all good. Rob talks about how the world is recognizing that the dollar is weakening and not seen as a safe haven, but some still have an a belief that it can not totally debase. Rob says that market for gold is still only around 2-3% and if it doubles or triples it will cause the price of those metals to go a lot higher. He mentions how the Chinese government was advising their citizens to take their U.S. Dollar holdings and put them into Gold and Silver. Rob provides additional information on Gold miners (Major and Minor) as well as current discoveries.

Jim Rickards - Discusses QE and how it must continue on after June, yet the FED is saying it won't continue beyond June 30th. Jim says that stock prices have been held up by QE and if we were to remove it then the stock market would crash. Jim says the official stance by the FED for now that they will continue. Jim points out that the FED deals in STOCKS (the size of the balance sheet) and FLOWS

(the incremental purchases under QE). Jim says "The FED's balance sheet is so large that the stock is slow large that it has become the flow". This is an interesting statement as he goes on to point out that the FED could stop QE in June and as its securities start maturing, they could take this money and continue to pump the economy (or monetize) with it, thereby creating perpetual QE. The FED's definition of QE is expanding the balance sheet, Jim thinks they have expanded it so much that they can keep QE going without expanding the balance sheet anymore, just by using the proceeds of the maturing securities. Jim goes on with an example of how this would be done, thus creating stealth QE and misleading the people. This is must listen information from Jim, I encourage you to listen to it in its entirety.

Subscribe to:

Comments (Atom)