This blog attempts to educate people about how our economy works and to provide updates on what is going on in the economy that may affect them (See personal story at the bottom of the page). Neither this blog nor I are investment advisors, any opinions posted on this site are my own. Please seek a professional investment advisor to fit your personal investment goals.

Economic Charts

All economic charts are at the bottom of the page.

Wednesday, November 17, 2010

Monthly Building Permits & Housing Starts

Octobers Building Permits and Housing Starts data disappointed the market on the whole. Building Permits is the annualized number of new residential building permits issued during the previous month and is looked at to gauge new construction. Housing Starts are the annualized number of new residential buildings that began construction during the previous month and is considered a leading indicator of economic health as it has ripple effects on jobs. The forecast for building permits called for 0.57 million, but the actual headline number was 0.55 million. Although this was a disappoint on the forecast, it was inline with Septembers data. The forecast for housing starts called for 0.59 million, but the actual headline number was 0.52 million, which was also a disappointment compared to Septembers number. I think betting on housing to create jobs is a failed strategy, there is only so much you can expand and we need to look at how we can grow jobs through agriculture and energy creation (in the U.S.), which would be a more productive use of jobs.

| Economic Indicator | Actual | Forecast |

|---|---|---|

| Building Permits | 0.55M | 0.57M |

| Housing Starts | 0.52M | 0.59M |

FED POMO Purchase

The FED has the printing press in hyperdrive now. The Fed executed another POMO (Permanent Open Market Operation) Purchase today worth $8.154 billion dollars, bringing the total since August 17th 2010 to $104.210 billion dollars. You can see in the charts below that the Fed has stepped up purchases.

This should be good for Gold and Silver, unless the price is being suppressed (as it has been in the past week).

OPERATION 1 - RESULTS| Operation Date: | 11/17/2010 |

| Operation Type: | Outright Coupon Purchase |

| Release Time: | 10:15 AM |

| Close Time: | 11:00 AM |

| Settlement Date: | 11/18/2010 |

| Maturity/Call Date Range: | 02/15/2018 - 08/15/2020 |

| Total Par Amt Accepted (mlns) : | $8,154 |

| Total Par Amt Submitted (mlns) : | $29,905 |

Tuesday, November 16, 2010

Monthly PPI and Core PPI

Octobers PPI disappointed analysts today as their goal seemed to be to obtain inflation. PPI (Producer Price Index) is the change in the price of finished goods and services sold by producers and Core PPI which is the same as PPI less food and energy. The forecasted number for PPI was 0.7%, but the actual headline number was 0.4%, which was consistent with Septembers number as well. Personally I think less inflation is a good thing for consumers. The forecasted Core PPI called for 0.2% inflation, but the actual headline number was less coming in at -0.6% (below Septembers 0.1%). As creating inflation is what the FED is trying to do (as he does not like deflation), this was seen as a disappointment. Foods decreased from Septembers 1.2% to -0.1% in October and energy increased considerably from Septembers 0.5% to Octobers 3.7%.

Corrected POMO Aggregate Graph

I corrected the POMO Aggregate Graph, as it wasn't showing the last few days of action which shows a spike in purchases made by the FED.

FED POMO Purchase

The FED has done another POMO (Permanent Open Market Operations) purchase today. The purchases seem to be getting closer together. Today the FED purchased $5.419 billion in Treasuries bringing the grand total since August 17th 2010 to $96.056 billion dollars.

OPERATION 1 - RESULTS

| Operation Date: | 11/16/2010 |

| Operation Type: | Outright Coupon Purchase |

| Release Time: | 10:15 AM |

| Close Time: | 11:00 AM |

| Settlement Date: | 11/17/2010 |

| Maturity/Call Date Range: | 05/31/2012 - 05/15/2013 |

| Total Par Amt Accepted (mlns) : | $5,419 |

| Total Par Amt Submitted (mlns) : | $33,527 |

Monday, November 15, 2010

Monthly Business Inventories

The September 2010 Business Inventories were released today with a less than favorable showing. The Business Inventories report measures change in the total value of goods held in inventory by manufacturers, wholesalers, and retailers and is issued 45 days after the month ends. It is considered to be a leading indicator of future business spending as inventories are being depleted, businesses are going to have to spend more to create more inventory ( also has a correlation to consumer spending). The forecast called for a 0.6% increase, but the actual headline number showed a 0.9% decrease. Retailers did better than manufacturers and Merchant wholesalers, as sales increase was higher than the inventories increase. Merchant Wholesalers doing the worst.

| Industry | Inventories | Sales |

|---|---|---|

| Manufacturers | 0.66% | 0.40% |

| Retailers | 0.77% | 0.79% |

| Merchant Wholesalers | 1.51% | 0.41% |

A link to the report can be obtained here.

Updated FED POMO Purchase

The FED initiated another POMO (Permanent Open Market Operation) purchase. A POMO Purchase is when the FED buys treasuries from the Primary Dealers (TBTF Banks) too bring onto his balance sheet (aka. Printing Money). Today $7.923 was purchased bringing the total since August 17th 2010 to $90.673 billion dollars. This is the largest POMO purchase since August 17th 2010. We are definitely in accelerated printing mode here.

It is too bad that metals prices tend to be suppressed (by the same banks that are the Primary Dealers btw), otherwise gold and silver would be much higher (no conflict of interest there).

| Operation Date: | 11/15/2010 |

| Operation Type: | Outright Coupon Purchase |

| Release Time: | 10:15 AM |

| Close Time: | 11:00 AM |

| Settlement Date: | 11/16/2010 |

| Maturity/Call Date Range: | 05/31/2016 - 11/15/2017 |

| Total Par Amt Accepted (mlns) : | $7,923 |

| Total Par Amt Submitted (mlns) : | $28,005 |

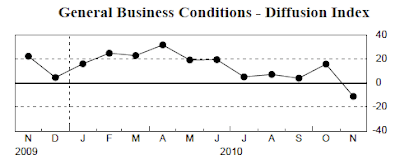

Empire State Manufacturing Index Takes a Dive

The November Empire State Manufacturing Index measures the level of a diffusion index based on surveyed manufacturers in New York state and is considered to be a leading indicator of economic health as it measures business activity, new orders, shipments, unfilled orders, inventories and hiring. Prices paid improved, but was offset with prices received as well. The current outlook saw conditions across the board getting worse.

Figure 1. Courtesy of the Federal Reserve Report

Figure 2. Courtesy of the Federal Reserve Report

Figure 3. Courtesy of the Federal Reserve Report

Figure 4. Courtesy of the Federal Reserve Report

The Forward looking report all categories improving (assuming due to the Christmas season), but the forward looking indicator from last report saw this month being better as well.

Monthly Retail Sales

The October Core and Non-Core Retail Sales numbers were released this morning looking favorable. Retail Sales is the change in the total value of sales at the retail level and Core Retail Sales is the same, excluding automobiles. These are considered to be vital data as it is a gauge of consumer spending, I would say that it is screwed due to the Christmas holidays. The numbers are actually down across the board (-2.67%) from Augusts numbers, but up across the board since October 2009 ( this could also have to do with the inflation we have been witnessing across the board, so we have to pay more to get the same things).

Sunday, November 14, 2010

Weekly M1 and M2 Money Supply

Last weeks Money supply showed a 0.44% increase in M1 (month-to-month) and a 0.26% increase in M2. For monthly M3 please refer to the bottom of the pages link to the shadowstats.com graph showing M3. Figure 1 shows the change in M1 and M2 week to week, as you can see it is on a steady rise in dollars.

Figure 1

Figure 2 shows the percent change in M1 and M2 from the previous year and shows M1 rising (short term) moving sideways from a longer term view. You can see that in the latter half of 2009 we had a decline in money supply, as our money supply is debt backed. As debt dried up due to defaults, write-downs, loan modifications and consumers paid down debt (plus many other reasons) the money supply contracted. The FED has increased money printing in 2010, which is helping offset the decreases in debt (due to the reasons stated prior) making it appear to move sideways year-over-year.

Figure 2

Taking a look at M3 for the year in figure 3, we can see that M3 started expanding approximately Mid 2010 and has really ramped up (coinciding with money printing activities such as POMO).

Figure 3

The following are the breakdowns of the different Money supply categories according to Wikipedia

- M1: Bank reserves are not included in M1.

- M2: represents money and "close substitutes" for money.[13] M2 is a broader classification of money than M1. Economists use M2 when looking to quantify the amount of money in circulation and trying to explain different economic monetary conditions. M2 is a key economic indicator used to forecast inflation.[14]

- M3: Since 2006, M3 is no longer published or revealed to the public by the US central bank.[15] However, there are still estimates produced by various private institutions. (M2 +large deposits and other large, long-term deposits)

Subscribe to:

Posts (Atom)